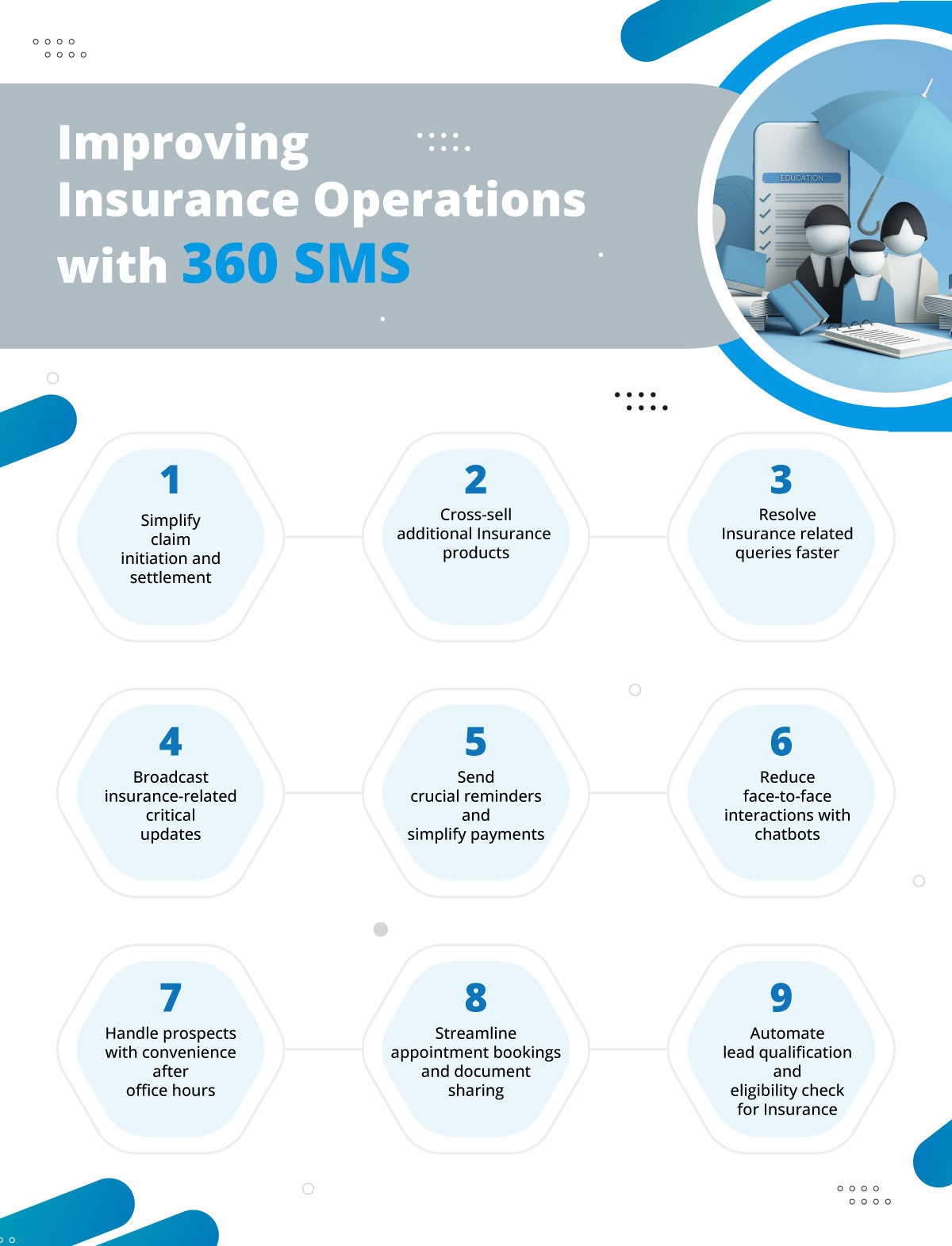

Struggling to Boost Insurance Sales? Here’s How 360 SMS Can Take Charge

Struggling to Boost Insurance Sales? Here’s How 360 SMS Can Take Charge

Sales have always been a concern for every firm, regardless of its vertical. Be it Healthcare, Real Estate, or Insurance, the ultimate goal of every industry is to maximize customer satisfaction without compromising their sales targets.

What’s needed here is the right and advanced solution that can help you in any manner to boost your sales.

We believe 360 SMS, an advanced Salesforce native-texting solution, can do wonders for every goal you want to achieve for your business. This is because communication is the key.

Insurance is one of the challenging industries, making it tough for insurance agents to propel their sales graph. But things change when you have communication clear and effective across all stages of an insurance journey. with effective communication from

In this blog, we will explore how 360 SMS helps insurance companies resolve their sales concerns and boost their sales. In addition, you will learn how insurance agents can build relationships by using 360 SMS to send SMS from Salesforce.

Send SMS from Salesforce Impactfully to Refine Insurance Operations

Reduce Face-to-Face Interactions

360 SMS allows you to build chatbots without coding. Thus, by creating chatbots, agents can provide a convenient self-service option for customers to inquire about insurance products, coverage options, and add-ons via text message.

Customers can interact with the chatbot to explore different insurance plans, receive information about policy features and premiums, and even make purchases directly through SMS.

Using the option of Salesforce text message chatbots, insurance businesses can make their services convenient to clients and enable them to adjust the details of insurance policies without personal interactions with an insurance agent.

Automate Qualification and Eligibility Check for Insurance

By implementing chatbots for insurance operations, you can easily automate the lead qualification process and invest your time in leads that are worth pursuing. It becomes easy to collect crucial information without manual intervention to assess their suitability for insurance coverage.

With an automated series of questions, chatbots gather information related to age, health, occupation, and other aspects of a person’s life. This allows users to quickly assess prospects according to the insurance products they wish to buy through insurance companies.

In this way, insurers increase their effectiveness and productivity while reducing manual interventions. Also, they can provide quick feedback on eligibility and expedite the insurance application process.

Simplify Claim Initiation and Settlement

Employing automated Salesforce text message conversations for insurance involves setting up systems that facilitate effortless initiation and resolution of insurance claims. The ideas are to automate replies to respond to customers as soon as possible, reduce the time taken to handle complaints, and address the claims quickly and without delay.

Broadcast Updates and Simplify Payments

Automated messaging is also a powerful tool for insurance companies and they can use text messages to communicate policy updates to the client. Since the text messages can be delivered to customers’ mobile phones, the insurers can ensure that the intended message gets to the customer whether they are at home, in school, at work or any other place without access to an email address or the internet.

Additionally, Salesforce text messages can be used to send branded URLs that direct customers to secure payment portals or platforms for submitting required documents. This streamlined approach enhances customer convenience, simplifies the payment and document submission process, and reinforces the insurer’s brand identity.

Cross-sell Additional Insurance Products

SMS allows users to easily connect at scale, and users can take advantage of this capability to cross-sell insurance products like life, health, dental, disability, and retirement plans based on past purchases to existing customers. Through targeted messaging, insurers can highlight product benefits, provide relevant information, and encourage customers to explore further. This Salesforce texting cross-selling approach maximizes revenue potential, boosts customer retention, and offers valuable protection solutions to meet evolving needs.

Send SMS from Salesforce for Crucial Reminders

Proactively send reminders for premiums, policy lapses, and expiry dates to prevent potential issues stemming from missed payments. These reminders serve as gentle prompts to ensure customers stay on track with their insurance obligations, avoiding unnecessary lapses in coverage and financial setbacks.

By offering timely notifications, insurers demonstrate their commitment to customer support and help foster a sense of responsibility among policyholders regarding their insurance commitments. Whether it is reminders, alerts, or one-on-one interaction, 9 out of 10 customers like to interact with businesses through SMS.

Push Notifications for Critical Updates

Improve and optimize the quality of customer experience by sending notifications on the ongoing status of a claim or when a claim is credited. When claim balancing is done, sending immediate communication to inform the customers about the progress of their claims hence placing confidence in the insurance process.

Streamline Appointment Bookings

SMS makes appointment management much easier. It provides a convenient platform for insurance agents and customers and allows for convenient appointment rescheduling.

Agents can also automate confirmation once the appointment is booked. With this flexibility, insurers enhance customer satisfaction and efficiency in appointment management.

Resolve Insurance Related Queries Faster

Accelerate customer access to policy-related information by connecting them to answers swiftly. With a communication channel such as Salesforce SMS, clients can quickly send inquiries on the policies and coverage, as well as any other details concerned.

This approach also ensures that the customer obtains the necessary information at his/her earliest convenience, hence maximizing customer trust and satisfaction.

Simplify Document Sharing

Facilitate seamless sharing of policy documents and provide immediate responses to customer inquiries to expedite the closing of deals. By enabling efficient document sharing and swift responses, insurers demonstrate professionalism and responsiveness, enhancing the customer experience.

This streamlined process also helps in building trust and confidence in the insurance company’s services.

Prioritize Prospects Convenience After Office Hours

Users can program voice messages when office hours are over. This feature enables customers to provide messages or questions that require a response when the office is closed so that the office can contact them back and attend to their issues first thing when the office reopens.

This way, insurers show dedication to consumer satisfaction as well as address the diverse needs of customers, thus increasing their satisfaction and loyalty levels.

Conclusion

360 SMS is an extensive solution that can help boost insurance relationships & sales. This platform would facilitate insurers in connecting with the customers at every stage of the insurance process, ranging from initial conversations to closing an insurance deal, thus making insurance simpler for everyone involved. Having SMS capabilities would enable insurance producers to better interact with the policyholders, inform the clients of policy terms, provide essential information fast and be successful in their sales appeals. Hence, by leveraging the capabilities of 360 SMS, it will be possible for insurance firms to create value and transform engagement with customers into a permanent partnership for revenue generation and a string of successes within the competitive insurance sector.

Ready to transform your insurance interactions? Drop us a line at care@360smsapp.com or click here to contact us.