Empower Your Mortgage Team: Accelerate Operations with Salesforce Texting

Empower Your Mortgage Team: Accelerate Operations with Salesforce Texting

Are you finding it difficult to manage your mortgage operations at scale and communicate with your potential?

Are you struggling to finalize a mortgage transaction faster?

Well, you are not alone.

Various mortgage lending firms face the same kind of issues. From loan approval to funding, there are several stages where mortgage lenders need to communicate with their borrowers.

If a mortgage lending firm fails to communicate with its borders effectively during the mortgage lending process, it leads to customer dissatisfaction and disloyalty. In addition, it also blocks the way for more new opportunities in the future.

So, to simplify and accelerate mortgage operations, we have got you a solution that can transform your mortgage workflows drastically- Salesforce texting.

According to The Financial Brand report, financial institutions and banking are among the top three industries where 41% of customers wish to receive text messages.

In this blog, we will find out how Salesforce texting integration can prove to be your best move for performing next-level mortgage operations and making them smoother and faster.

Salesforce Texting Integration for Mortgage

Let’s have a look.

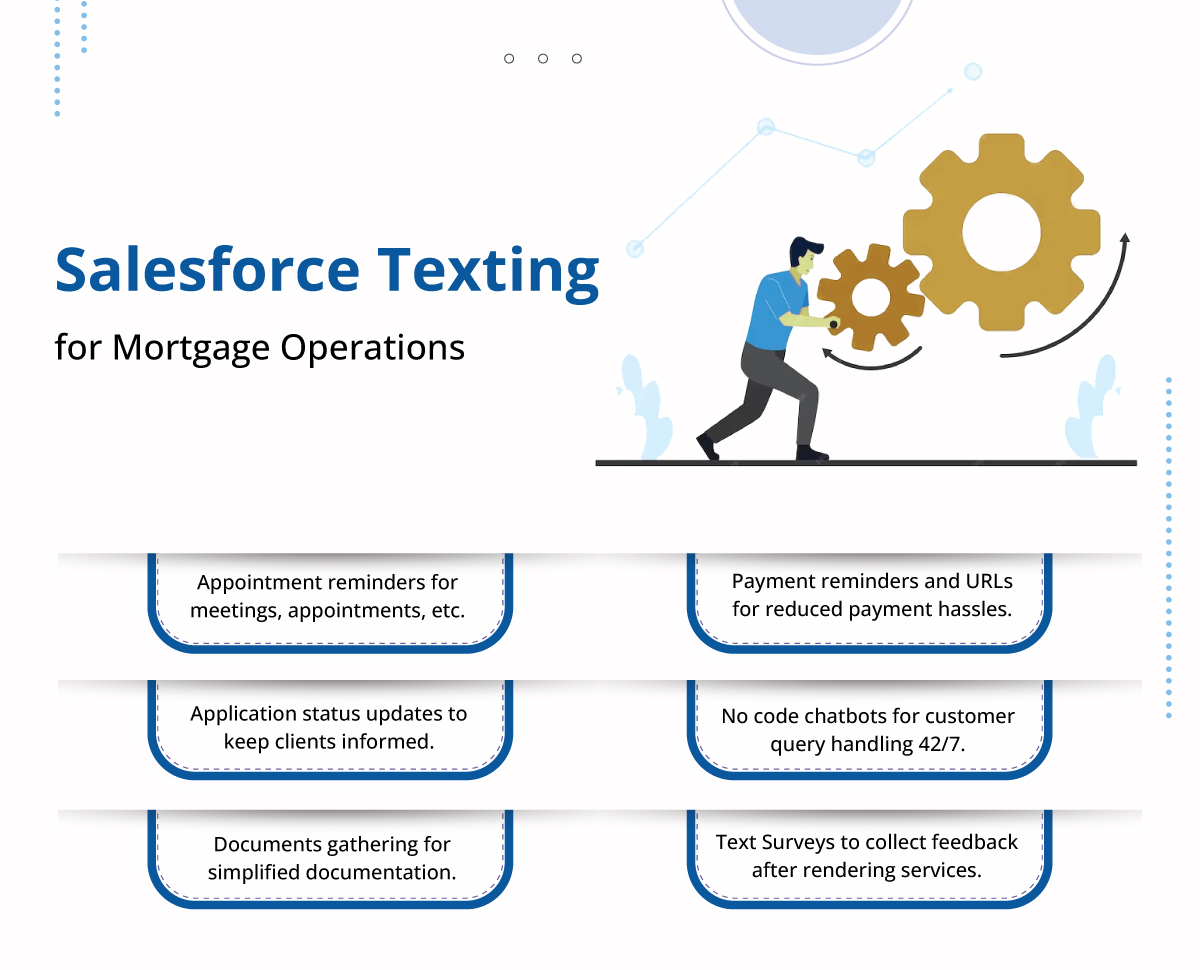

Appointment Reminders

Delay at every stage is one of the major causes that lead to the increased time frame of mortgage operations. And the reason for the delay from the borrower’s side is a busy life and hectic schedules. Therefore, you can initiate sending reminders wherever required to streamline the process. For this, you can count on Salesforce to send text messages.

Mortgage firms can send automated text reminders to borrowers and clients about upcoming appointments, such as loan application meetings, document submissions, or closing dates. This reduces the likelihood of missed appointments, streamlining the process.

According to the G2 report, only 20% of firms send SMS reminders, whereas 83% of customers want to receive reminders through SMS.

Application Status Updates

Whenever a borrower applies for a loan, it is for a specific objective or to possess something, for example, a property. As a result, they are always eager to get quick funding, and you can expect them to be a little impatient about tracking the progress of the loan application.

You may have to face back-to-back calls or text messages from borrowers to collect updates, which keeps Mortgage lenders busy and might affect their efficiency.

Keeping borrowers informed about the status of their loan applications is crucial. You can automate and send Salesforce text messages to provide regular updates on the progress of their loans timely, including milestones achieved and any additional documentation needed.

Easy Documentation

Documentation is one of the crucial operations that the mortgage industry deals with. Also, the documentation process involves too much back-and-forth communication between lenders and borrowers, which must be streamlined for a smooth process. The delay is obvious when mortgage communication depends entirely on emails and calls.

One must wait for the other end recipient to receive a call in case of calls. In the case of emails, you can expect a delayed response, which makes the documentation process time-consuming. With the help of text messages, you can avoid the inconvenience and delays faced in the case of emails and calls.

Mortgage firms can request necessary documents from borrowers via text message, making it convenient for borrowers to submit required paperwork by taking photos or scans and sending them through text.

Reduced Payment Hassles with Salesforce texting Integration

One of the biggest problems of the mortgage industry is untimely payments. This is something that causes inconvenience to mortgage lenders and borrowers. Salesforce texting integration in the mortgage industry helps to a great degree when it comes to payments. Not only can you foster on-time payments, but you can also simplify the payment process for your borrowers, adding convenience.

For borrowers with existing mortgages, sending payment reminders via text can help ensure on-time payments. You can also send text messages from Salesforce, including payment due dates and convenient payment options. Plus, you can send payment URLs to simplify the payment process and reduce extended navigation that causes inconvenience and leads to delays in payments.

Chatbots for Customer Query Handling

Undoubtedly, chatbots have become a powerful ingredient for effective customer handling in any industry. Even the mortgage industry is no exception. A proper Salesforce texting integration provides no code text automation, which you can use to configure chatbots.

Implementing a chatbot on the mortgage firm’s website or through texting can help answer frequently asked questions, guide borrowers through basic inquiries, and provide instant assistance outside business hours.

This helps you deliver quality services to your borrowers and earn customer loyalty, improving long-term relationships.

Salesforce Texting Integration for Text Surveys

Another way to use Salesforce to send text messages is by running text Surveys.

Customer satisfaction and better relationships help you drive repeat business. With a code text automation solution, you can also configure text Surveys apart from configuring chatbots.

Mortgage firms can use text surveys to gather feedback from borrowers about their experience with the firm’s services. This information can be invaluable for improving customer satisfaction and operations.

Send Text Messages from Salesforce and Speed Up Mortgage Operations

Communication is the key to streamlining business operations, regardless of your business vertical. For mortgage operations, there are countless ways to send text messages from Salesforce and stay connected with borrowers at different stages of the loan cycle. More importantly, one can also automate interactions in a meaningful way to a great degree.

By incorporating texting into their operations, mortgage firms can enhance customer engagement, streamline processes, improve communication, and ultimately provide borrowers with a more efficient and convenient experience. Want to dive deeper into what’s more you can do with texting for mortgage operations? Turn to our experts at care@360smsapp.com or click here to contact us.

FAQs

Yes, SMS communications are secure only when you cautiously choose your texting solution. The best thing you can do in this concern is choose a serverless texting solution that doesn’t store any data. This way, whatever data is exchanged through text messages stays secure, and there is no risk of data leakage.

It is very easy to send different types of reminders related to mortgage operations timely. If you have the right texting solution, you can simply automate reminders by setting the frequency as weekly, monthly, or annually. This way, you do not have to intervene to send reminders, saving time and manual effort.

Quiz Time

What type of automation does a proper Salesforce texting integration support for a chatbot?

A) Process Builder

B) No-code

C) Workflows

D) Flows

Show Answer: B) No-code