Mortgage Operations are Next-level with 360 SMS. Find out How?

Mortgage Operations are Next-level with 360 SMS. Find out How?

It’s never easy to break the ice between insurance agents and prospects; it takes several meaningful connections and attempts, no matter what you’re goals are. Whether it is about nurturing leads, retaining customers, or closing deals, you always need a reliable and effective communication channel for the smooth and free flow of mortgage operations.

This is where 360 SMS will surely be your best bet. With its out-of-the-box capabilities, it becomes easy to simplify mortgage operations, regardless of your goals. Today, in this blog, we will find out how using 360 SMS Salesforce to send SMS can lead to a 360-degree change in mortgage operations.

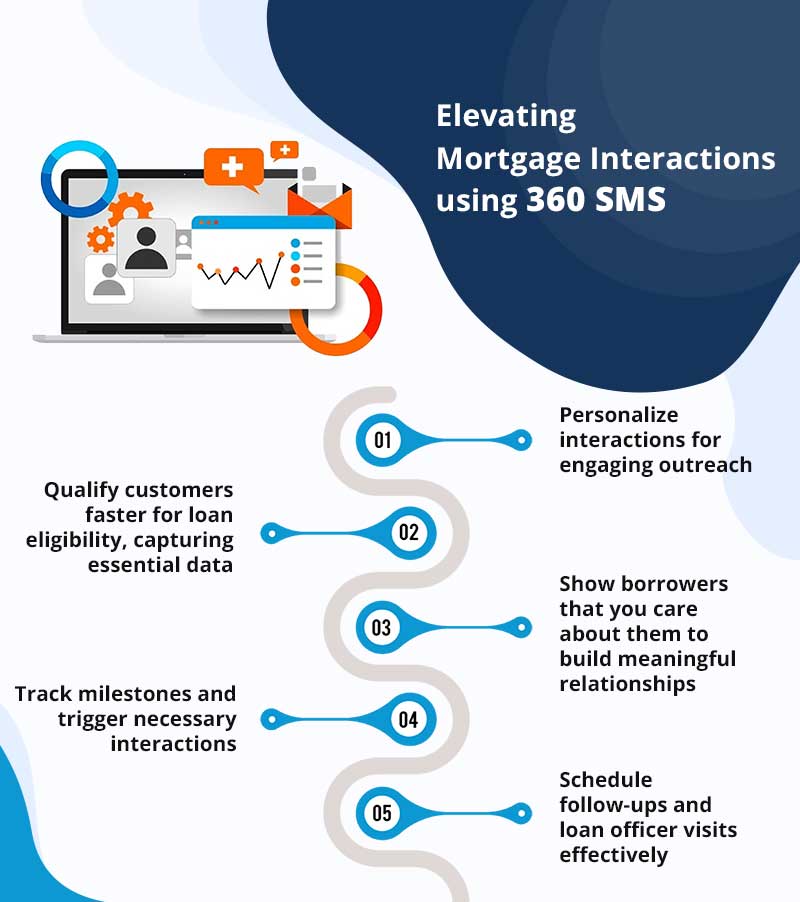

Redefining Mortgage Interactions using 360 SMS for Salesforce to Send SMS

Seize the Moment with Personalized Messaging

Seize the Moment with Personalized Messaging

Around 46% of firms in the finance and banking sector have increased their text marketing spending over the past three years. This shows the significance of texting in the finance sector. In the competitive world of mortgage operations, timing is crucial. Leads often forget your brand within the first 10 minutes if they aren’t engaged, getting lost in the vast digital noise. To ensure your brand stands out and makes a lasting impact, it’s essential to reach out with a personal touch right away.

360 SMS empowers you to send tailored messages within 2-3 minutes after a lead submits a contact form. This immediate, personalized communication not only demonstrates your approachability but also ensures you’re the first to connect with the lead, giving you a competitive edge. A prompt, friendly message can break the ice and set the stage for a positive customer experience.

By leveraging merge fields and templates, you can craft custom messages to send SMS from Salesforce using the information provided by your leads. Addressing them by their first name and including relevant details shows that you value their interest and are ready to assist them personally. This helps build a connection and makes your outreach more engaging and memorable.

With 360 SMS, you can capture attention early, keep your brand top of mind, and create a strong foundation for future interactions. This proactive approach not only improves lead retention but also enhances the overall customer journey, driving better outcomes for your mortgage operations.

Capture Essential Data, Qualify Customers Faster for Loan Eligibility

Accelerate the loan qualification process and enhance customer interactions with 360 SMS by configuring Decision Trees and Dynamic Questionnaires without any coding. These powerful tools automate interactive questions based on keyword replies, streamlining the data capture process and ensuring accuracy.

By implementing Decision Trees and Dynamic Questionnaires, you can efficiently gather critical information from applicants. This automation helps to quickly determine their eligibility and inform them of the loan amounts and revised mortgage rates they qualify for. These tailored questions guide applicants through a seamless process, providing instant feedback and clarity on their loan options.

This approach ensures that your teams are equipped with all the necessary details, enabling them to provide accurate and timely responses. With more qualified leads, your sales and service representatives can focus on meaningful conversations that directly address customer needs and concerns. This improves the efficiency of your loan qualification process. Also, it enhances the overall customer experience, driving better engagement and higher satisfaction rates.

Show Borrowers They’re More Than Just a Number with Meaningful Automation in Salesforce to Send SMS

Scale Personalization: Set yourself apart by running reports to automatically send SMS from Salesforce that are personalized. By leveraging 360 SMS, you can efficiently scale personalization efforts, ensuring that each borrower feels uniquely valued.

Send Birthday Notifications: Refer to demographic data to emphasize longevity and important birthdays. Engage borrowers, agents, and realtors on their birthdays to show them that their respective relationships are valued. This also shows that you remember their important occasions.

Congratulatory Messages: Firm up your relations with others by acknowledging significant accomplishments. For example, you may have closed a deal, refinanced, or obtained loan approval. To showcase your appreciation and desire to see them succeed further, send SMS from Salesforce to congratulate them. This would go a long way.

This way, the messages can also be presented as thoughtful communications, which would help you improve customer satisfaction and loyalty. Ensure that each communication is special and not repetitive. With 360 SMS, you can guarantee that borrowers are more than simply numbers. This will enhance organizational relationships and the brand image you present.

Track Milestones and Trigger Timely Actions

Ensure no application falls through the cracks by setting up a guided application process with 360 SMS. This approach allows you to scale relevant communications and actions at each stage, capturing time-sensitive opportunities and ensuring a smooth journey for your applicants.

Scale Relevant Communications: Automate outreach across various communication channels to ensure that all stakeholders are informed about the progression of the application process and the next steps. Make it a culture to send SMS using Salesforce to share progress information using SMS, email, and other forms of communication to keep the applicant and the rest of the team informed.

Capture Field Data: Document basic field data at every step of the application process. This allows for set follow-ups, which allows applicants to continue loan conversations from previous sessions.

Automate Multi-Channel Interactions: Automate communication by sending emails to all stakeholders to inform them about the application’s progress and the next steps. This not only makes the business transparent but also develops credibility and confidence in your services.

Schedule Follow-Ups and Loan Officer Visits Effectively

Ensure a seamless follow-up process by updating custom field data to reflect the status of each application, whether it is ineligible, abandoned, or closed. This accurate data management allows you to tailor your approach based on the application’s current state.

Utilize this data to trigger timely actions, such as scheduling follow-ups for 1003 documentation. Send SMS using Salesforce to automate reminders and set up loan officer visits to address any outstanding requirements or provide additional support. Overseeing each application and then managing follow-ups enhances customer interaction and the overall lending cycle.

At the same time, it eliminates the possibility of missing any application while also keeping the applicants informed. Thus enhancing their experience and the chances of a positive result.

Conclusion

To achieve this, when you use 360 SMS to send SMS using Salesforce, you can enhance mortgage operations in the following ways. From pre-loan activities to follow-ups, there is much that can be done through 360 SMS. Filtering the initial interaction of your customers through an automated system allows your team to focus on more important tasks. This results in improved loan processing and high levels of customer satisfaction, hence increasing customer retention chances. Ready to upscale your mortgage interactions? Drop us a line at care@360smsapp.com or click here to contact us.